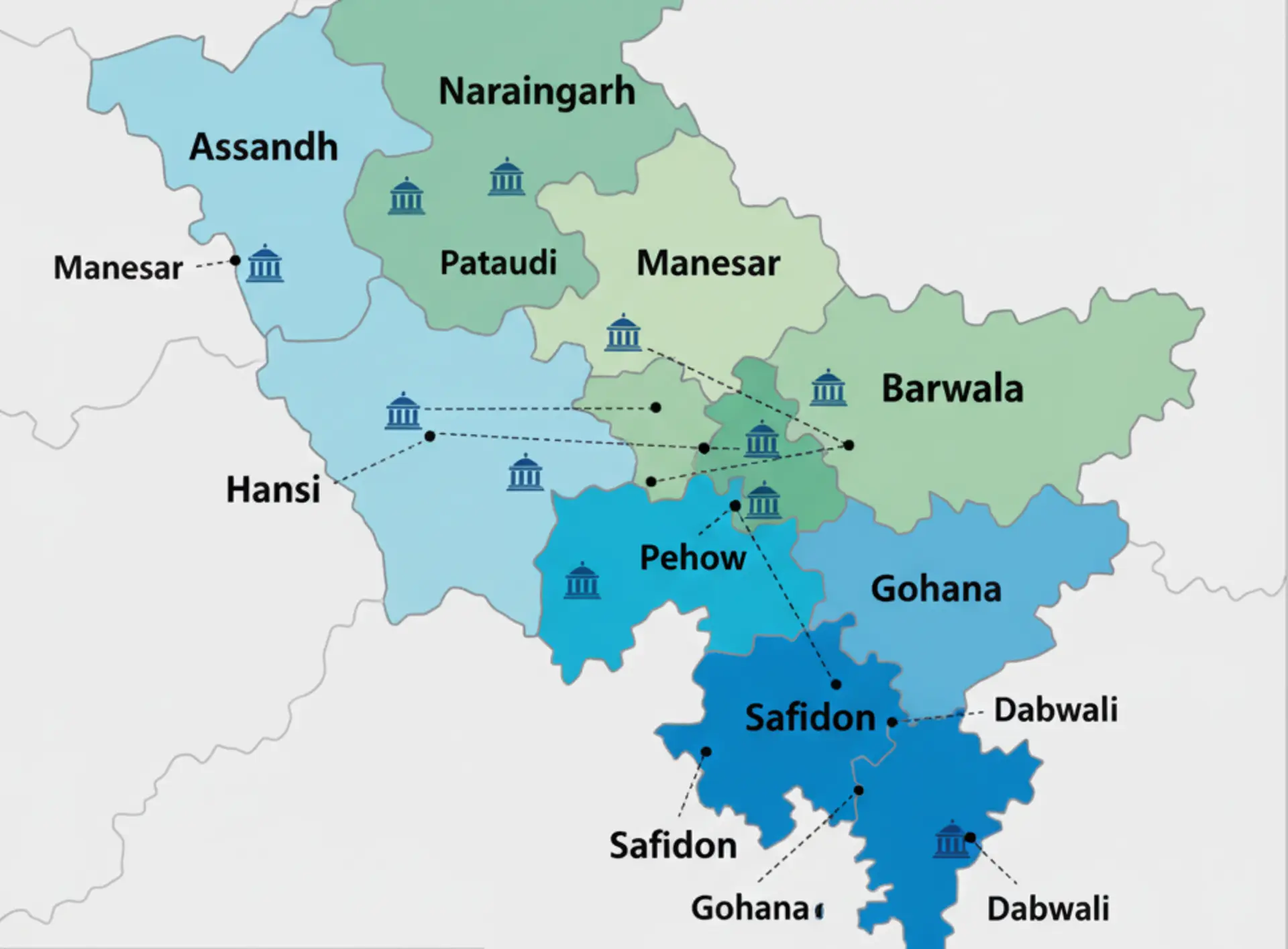

The state of Haryana is caught in an unsustainable debt cycle where new borrowings are largely used to service existing loans rather than funding development projects, according to the Comptroller and Auditor General, who has expressed grave concerns about the state's declining financial health.

The state's total debt soared from Rs 2.16 lakh crore in 2019–20 to Rs 3.27 lakh crore in 2023–24, a startling 51.52% increase, according to the CAG report presented to the Haryana Legislative Assembly. This surge stemmed mainly from rising public debt of Rs 99,360 crore and public account liabilities worth Rs 11,700 crore.

The audit findings expose a troubling financial pattern: between 36% and 67% of current borrowings during 2019-24 were used to repay earlier debt principal amounts. In 2023-24, merely 18% of borrowed funds supported capital expenditure that could drive economic growth and infrastructure development.

"Borrowed funds should ideally fund capital creation and developmental activities. Using borrowed funds for current consumption and interest repayment is not sustainable," the CAG emphasized, highlighting the state's precarious fiscal management.

During this time, the debt-to-GDP ratio slightly increased from 29.21% to 29.81%, meaning that total liabilities now exceed revenue receipts by 3.22 and the state's own resources by 4.05 times. Central loans total Rs 4,079 crore, while internal debt is Rs 2.80 lakh crore.

Haryana's long-term economic viability and its capacity to finance important infrastructure projects without further jeopardizing its financial situation are called into question by this financial assessment.